The filling of sterile drugs into the appropriate primary containers (in this case, prefilled syringes) is one of the most crucial steps in the entire

The filling of sterile drugs into the appropriate primary containers (in this case, prefilled syringes) is one of the most crucial steps in the entire production process. Moreover, properly and aseptically executed fill / finish operations are important for maintaining the quality, safety and efficacy of the drug till it reaches end users. Errors at this stage, such as microbial contamination and improper dose dispensation, have been shown to be associated with serious consequences, leading up to product recalls and legal ramifications. Regulatory scrutiny and high cost of product development and manufacturing have prompted the stakeholders in this domain to impose stringently control over fill / finish operations.

Given the fact that fill / finish operations require specialized equipment, expertise, and care, most of these operations are outsourced to the fill / finish service providers. A small fraction of biopharmaceutical manufacturers perform the filling activity in their own in-house facilities, whereas most of the companies utilize the fill / finish services of CMOs to take advantage of their expertise, and lyophilization and filling capabilities. These services are outsourced so that the biopharmaceutical companies can focus primarily on drug development and active pharmaceutical ingredient (API) manufacturing.

On an average, more than 80% fill / finish requirements are outsourced by the biopharmaceutical companies. However, the companies having in-house fill / finish capabilities outsource 40% of their requirements to the CMOs. In fact, small / mid-sized biopharmaceutical companies with no in-house biologic fill / finish capabilities completely outsource their operations to CMOs.

With the increasing trend of using self-injecting devices, such as prefilled syringes, the demand for fill / finish services are likely to increase. There are a number of reasons to believe that the fill / finish industry is likely to grow in the coming future; these reasons are outlined below:

- The growth of biopharmaceuticals is likely to drive the demand for fill / finish contract manufacturing. CMOs are now providing aseptic filling services and advanced technologies for handling complex molecules. Additionally, the entry of biosimilars in the market, because of patent expiries of a number of biologics in the coming years, is likely to contribute in the growth of the fill / finish

- Adoption of single-use disposable equipment for syringe filling; these systems provide many benefits, such as reduction of contamination risk, operation flexibility and shortened changeover times. It will further help in tangible cost savings and increase the speed to market.

- Fill / Finish CMOs are growing significantly through mergers and acquisitions. In September 2015, Pfizer CentreSource, (specialty APIs CMO) and Hospira One 2 One (sterile-injectables CMO) united to form Pfizer CentreOne, which focuses on API synthesis and fill / finish of sterile injectables.

- In order to prepare themselves for future needs, the companies have started investing money to expand and upgrade their manufacturing plants with new technologies. Vetter Pharma has planned to invest EUR 300 million to expand and upgrade its manufacturing facilities to meet the future demand.

- In January 2019, Catalent Biologics invested USD 200 million to expand its capacity and capabilities related to biologic drugs. Additionally, in the same month, FUJIFILM Diosynth Biotechnologies expanded its capacity and included fill / finish services for recombinant proteins.

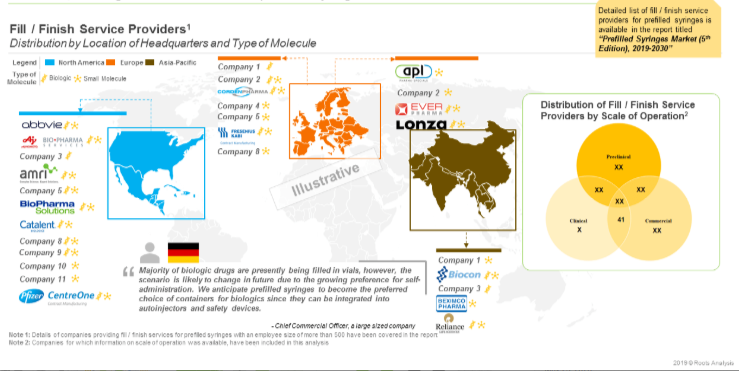

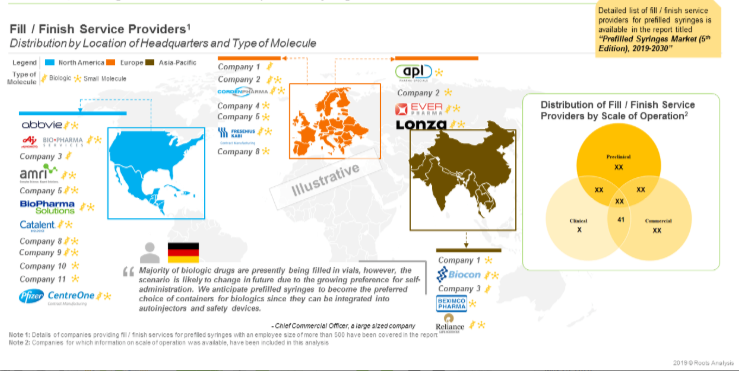

Close to 45 large contract manufacturing organizations (more than 500 employees) presently offer fill / finish services for prefilled syringes. Majority of the fill / finish service providers are based in Europe (19) and Asia-Pacific (13). Prominent players in these regions include (in alphabetical order, no selection criteria) AbbVie Contract Manufacturing, BioPharma Solutions, Boehringer Ingelheim BioXcellence, Catalent Biologics, Fresenius Kabi Contract Manufacturing and Pisa Farmaceutica.

Additionally, there are 26 players that manufacture elastomeric components for prefilled syringes. Examples of such players include (in alphabetical order, no selection criteria) Aptar Pharma, West Pharmaceutical, Datwyler Sealing Solutions, Lonstroff, Ompi and Jiangsu Hualan New Pharmaceutical Material

COMMENTS